Data Management for Maximal Reimbursement and Cash Flow!

Quantifying to the Bottom line

How to obtain maximal reimbursement? The solution is to have immediate access to accurate information, and business auditing capabilities that uncover mistakes in the process that create payment denials. The key to reimbursement is to eliminate payment denials.

There are five primary reasons for most payment denials:

- Front office knowledge of the patient’s insurance and specific plan coverage

- Front office work accuracy and patient follow up throughout the treatment process

- Competent and persistent billing staff

- Holding the payer accountable

- Provider documentation

Front Office Knowledge of the Patient’s Insurance and Specific Plan Coverage

It all starts with the patient and their insurance plan. One insurance carrier may have multiple plans with varied coverages. Primary to a successful practice is the accuracy and completeness of the verification of benefits (VOB), per the diagnosis. The items to be obtained from the verification of benefit: their copay, deductible, co-insurance, maximum benefits, any carve-outs in the plan, any previous related treatment this year and correct carrier authorizations for the course of treatment. Once the information is consolidated and the form accurately completed, the focus shifts to effectively caring for the patient with maximal reimbursement. Knowing the rules and restrictions is a part of any successful medical business. Note: Inaccurate data collection during the VOBs is the primary reason for most payment denials.

Front Office Work Accuracy and Patient Follow up Throughout the Treatment Process

The front office has the responsibility to collect, collate, dispense, and follow up on the patient, throughout the course of their treatment. They must understand and recognize the importance of the verification process from the beginning. The front office staff must be recognized as a resource that can effectively explain the details of their payer/patient responsibility. All front and back (billing) office employees are responsible to create and maintain an organized and efficient office space and processes that minimize errors.

Billing – Competent Staff and Persistent Processes

The back office (i.e., billing/collection/auditing services), either on staff or outsourced, is responsible for proper charging/billing and payment posting all contracted insurances companies associated with the clinic.

Denials can and do occur there, as well. Knowledgeable billing staff is key to controlling and managing the accounts receivable (AR). Their understanding of denials and why they occur, eliminates valuable investigative staff time on the phone with carriers.

It’s brilliant! The insurance companies create and maintain chaos within was a result of constant changes in the mandate, and their staff training has declined. Yes, they have morphed to online and overseas services, and that, in itself, has lessened their effectiveness, making it increasingly difficult for the provider. We would contend the present insurance payment system is over-complicated, inefficient and in constant change.

If the present data management system cannot promptly adapt to the change, the service is denied. And, if your billing staff is not actively working AR, then the loss of money for timely filing accumulates. Carriers have mandated 90-120 days to submit a correct claim, even though much of the delay in payment is on their end. Appeals can be made, but that takes more time and expense. Staying on top of AR is imperative for cash flow and should be a daily mandate.

Holding the Payer Accountable

The insurance carriers make just as many mistakes as the patient, front office and provider. They are counting on you not calling them and being able to figure out the issue. The statistics are that insurance companies are counting on you not to call them for non-payment. 50% of patients and clinics do not call on the unpaid claim the first time, and then, if required to call again, only 25% will call a second time. Providers must understand a carrier’s rules on submission, i.e. how many days from the date of service can a claim be submitted and whether authorization is a requirement. Every carrier has their own rules about how they want a claim completed, and, as mentioned, they make frequent changes. Also, to make matters more difficult, every carrier has their own denial codes.

Provider Documentation

The credentialed provider must be informed about the requirements (documentation) and benefit limits of the patient’s insurance policy, aach insurance company may have specific documentation requirements for what has been billed, and a provider must be able to provide documentation that meets the payers’ mandate, which most often includes the explanation of medical necessity. Understanding rules and regulations regarding the proper use of modifiers, per diagnosis, and billed CPT codes is the provider’s responsibility. Again, any one of these areas is a potential possibility for denial.

The Role of Data Management in Maximizing Business Success

Two primary tools for any business is to have immediate access to accurate reporting that provides a “snapshot” of each aspect of the business, and to create a bottom line auditing function, both clinically and financially.

To insure maximal cash flow and reimbursement, auditing should focus on three areas:

- Consolidated reporting

- Tracking payment denials

- Auditing work output of the front office and clinical staff

We learned the importance and value of data management from our 4 1/2-year onsite rehab experience at United Parcel Service in Cleveland, Ohio, in the early 1990’s. UPS manages their entire business with a sophisticated data management software and processes that have the capability to drill down into the data, and report their information and function throughout their business. They are able to track and report everything, in ways that are most meaningful to them. The reporting teaches them about every aspect of their business, and they make every decision based on data.

As a practicing PT and business owner, I thought at that time, medicine is nowhere close to that refinement. Over the years, we have been able to adopt this same methodology for our rehab business.

The decline in reimbursement and the chaos that lies within the insurance companies have forced the business owner to become a lean as possible, which is a requirement to sustain clinical practice. A successful business owner is forced to analyze every aspect of their business operations to the bottom line. Examples of data that lie at the bottom line are:

- Payment/Expense per Charge Minute, per Payer

- Number of Payment Denials

- Clinical and Offices Work Output Measures

Following are examples of three levels of reporting that positively correlate to each aspect of cash flow:

- Consolidated Reporting (Business Snapshot)

- Business Profile Summary

- End of Month Summary

- Tracking and Analyzing Payment Denials

- Auditing/Describing Work Output of the office billing, and provider staff or outsourced services

No more thinking, “I think that our staff is doing a good job.”

Assessment to the bottom line tells the story throughout.

Consolidating Data Reporting

The bottom line is: Payment per charge minute, per payer.

Like the UPS data management model, the overall goal is to generate reports and processes where all meaningful information is in one place; nothing is entered twice, with immediate access. The consolidated reports contain only the data required to provide a global snapshot of the clinical and of the business – billing collection. For example, at the peak of my clinical career we had four outpatient clinics, and on the 4th of January we received two pieces of paper that included all of the data for all clinics. The reports, entitled “End of Month Summary” and “Business Profile Summary.” These consolidated reports can be run for each clinic separately, or combined to include all clinic data.

Tracking Payment Denials

The bottom line is: who made what mistake, on what day and time.

One solution to maximal reimbursement and improved cash flow is a total understanding and the eventual elimination of payment denials.

A payment denial uncovers an error, or mistake made in the billing/payment process. The error can be made by the payer, the patient, the provider, front office, or the billing company. Once denied, the result is delayed payment by 45-60 days, if paid at all. Today’s business owners are very aware that it costs time and resources (money) to investigate the who, what, and when of the denied payment – which decreases the profitability of that service. As stated: fewer payment denials + fewer investigative personnel expenses = greater cash flow and revenue.

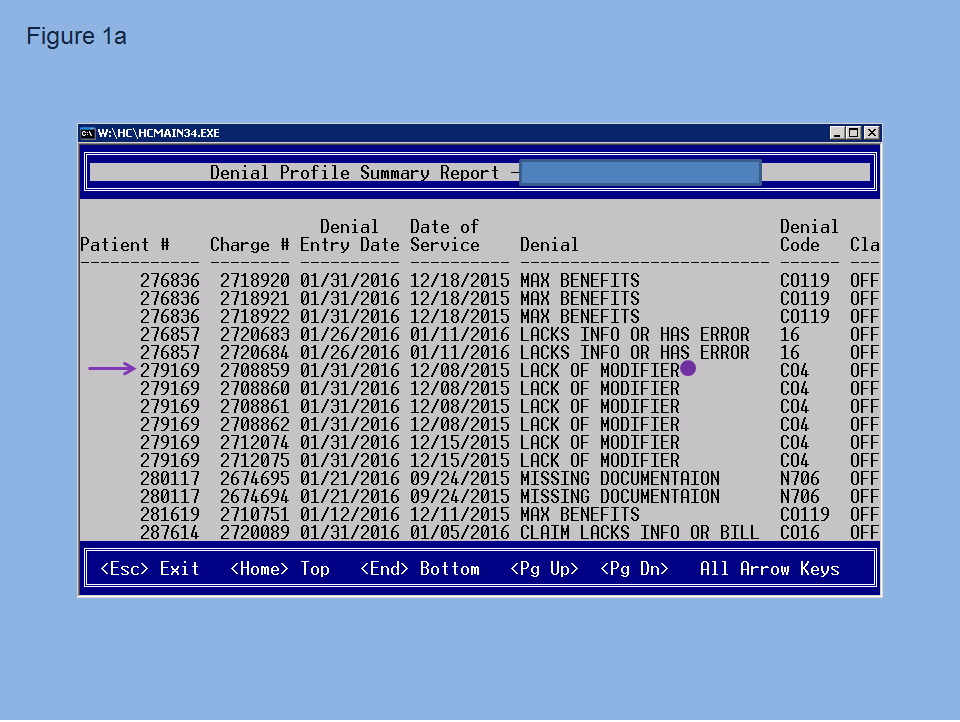

Following is an example of reporting that unveils and describes the details of a payment denial. Figure 1a is a denial summary profile report that reveals the denial on the patient number 279169 and the denial code CO4.

From there we reenter the software face plate, figure 1b, and choose “x” for auditing.

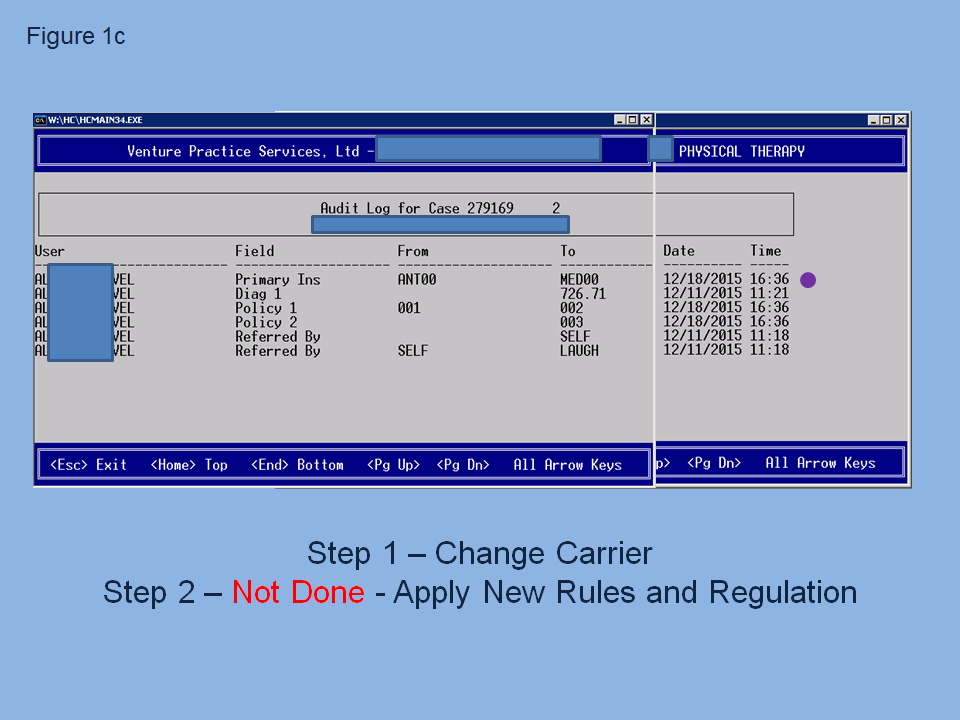

This takes us to figure 1c, the audit log that identifies the employee user, who made what mistake, at what time.

The error made was that patient changed insurance carriers mid-treatment, and at 16:36 on 12/18/15 the user (our staff) changed the payer from ANT00 to MED00, which is the first step of a 2 step process in the billing software. The error was that step 2 was not completed. That type of information is critical to sustain cash flow and is consistently used as foundation for staff education.

A successful process is to track the mistake, educate the staff, set performance goals, and develop a reward process for goals accomplished. The message to the staff is: we must study and learn from our mistakes. Work smarter, not harder! Most agree that consistent staff education with comparative statistics is essential for success. The two primary performance variables that we tracked in our practice were payment denials and days to charge entry.

To reach the bottom line in decreasing payment denials/errors, one must understand that the EOB denial code is not all telling. Therefore, to reach the bottom line of fully understanding the details of the denial, the EOB code has to be accurately and clearly classified as to who made the mistake, and categorized into an understandable definition as to why the charge was denied. It’s like translating one language (EOB) into another language, written in terms that we totally understand. The end result is a much clear comprehension and awareness of process. Thanks UPS!

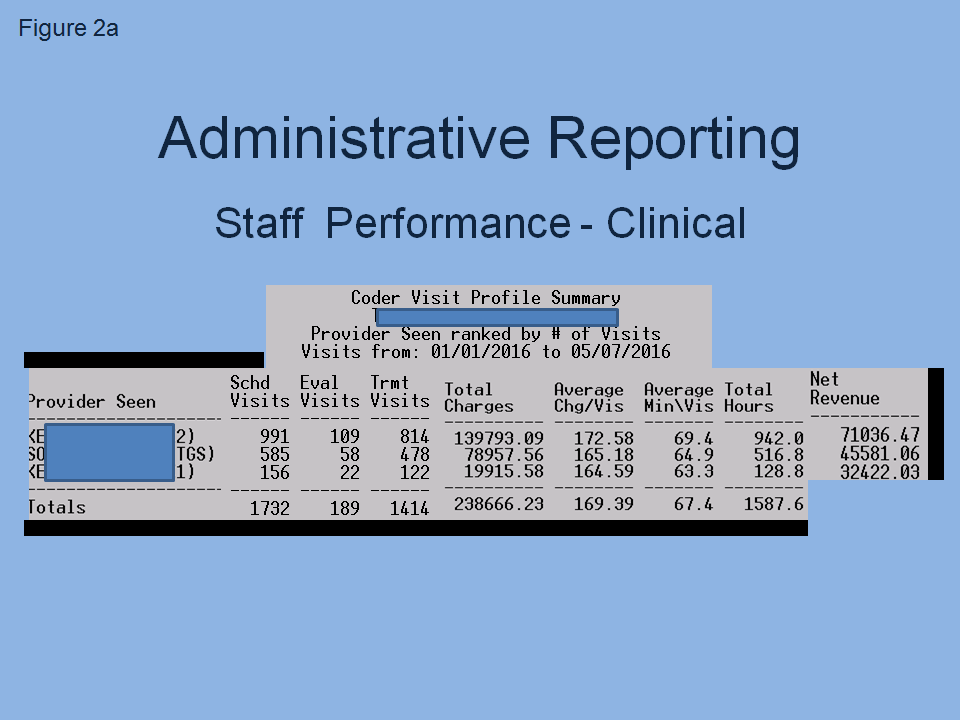

Auditing Performance Output of the Clinicians and Front and Back Office

Data points at the bottom line on the clinical side are:

- Visits

- Charges Generated

- Time Worked

- Employee Costs

- Net Revenues

- Profitability

Figure 2a is an example of a coder visit profile summary that tracks clinical performance.

On the office/business side, the bottom lines are:

- Keystrokes (characters)

- Transactions

- Notes

- Hours worked

- Days to charge entry

Tracking these tasks coupled with delineated job descriptions clearly defines the accuracy and amount of work performed.

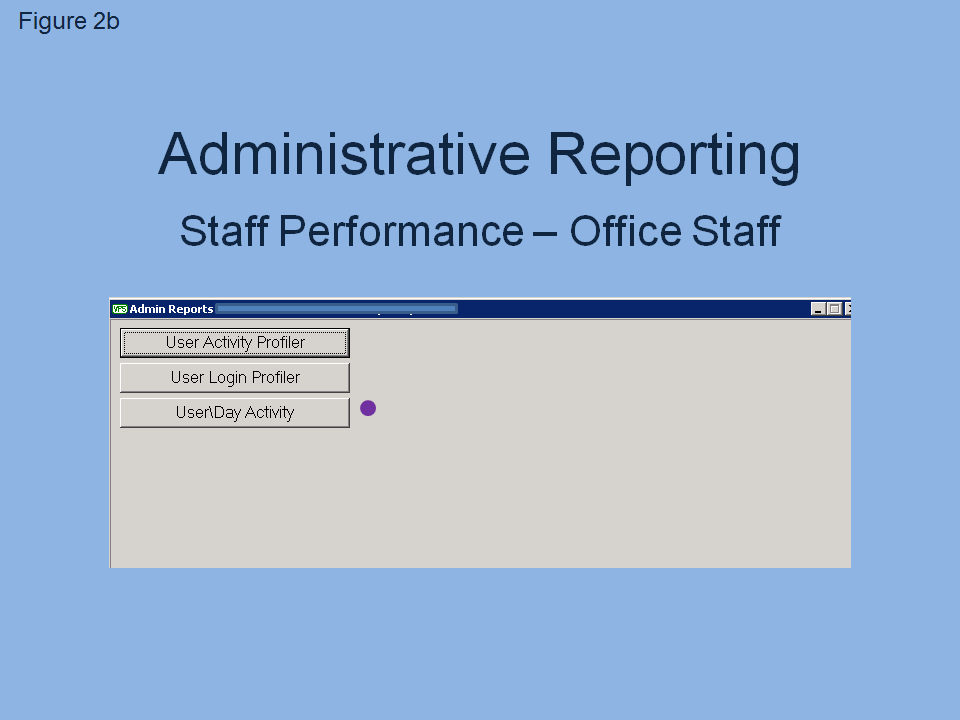

A common thought among business owners is, “I think our front and back office and/or outsourced services are doing a good job: setting up the patient, posting payments and working the Account Receivable (AR).” Being able to audit to the bottom line substantiates that thought. Particularly applicable is analyzing work done from outsourced and off site services, like working from home.

Figure 2b is an example of staff performance reporting to that bottom line called the User Activity Report.

Variables listed on that report include: employee, date, hours worked, transaction, charges, notes, characters, the client where the work was performed, and the quality of the actual note. Figure 2c is an example of that consolidated report that reveals each variable per day per employee. Days can be easily compared by one button click, up or back.

Auditing to this level completes the information loop, enhances cash flow and guards against cheating/fraud, i.e., an inverse relationship between time worked and work done.

Conclusion

Effective education is based on preparation, and having immediate access to valuable, descriptive information, from test scores and student performance assessment, and financial operations. One primary key to success is accurate reporting that tracks payment denials and the improvements in processes.

Successful clinical practices recognize the direct interrelationship between assessment and inconsistent staff education and training. Setting objective goals directed to improving cash flow, with minimal AR, is very effective when the operation can be reported to that bottom line detail.

We are all educators; clinicians, university professors and researchers. And, paramount to our success is the quality of our education throughout, and the depth and accuracy of the knowledge of our work. Thanks again, UPS!

James A. Porterfield, PT, MA, AT(ret) is the Owner of the Rehabilitation and Health Center, Venture Practices Services, LTD, a rehab specific medical billing company, and CEO of Acadaware, a software rehab-specific software design company.

Jim received his undergraduate degree in Comprehensive Sciences from Ash-land University in 1972. He completed his PT degree from the Mayo Foundation School of Physical Therapy in Rochester, Minnesota in 1974. Jim is a Licensed Athletic Trainer, and holds a Masters degree from Kent State University in Exercise Physiology (1986). Jim has presented nationally and internationally on numerous occasions and has presented over 300 workshops on the topic of functional anatomy, spine function and dysfunction, physiological adaptations to exercise and human performance. Jim has published in Spine, Journal of Occupational Medicine, Topics in Geriatric Rehabilitation, and Physical Therapy. He has also written numerous book chapters and and co-authored, with his colleague Carl DeRosa PT, PhD, three textbooks: Mechanical Low Back Pain: Perspectives in Functional Anatomy (Volume I and II) and Mechanical Neck Pain: Perspectives in Functional Anatomy, and Mechanical Dis-orders of the Shoulder: Perspectives in Functional Anatomy, Elsevier. These texts are currently being used in many physical therapy schools and available on line at www.acadaware.com within the Acadaware Education Institute (AEI).

As recognition of his significant contributions to the field of Physical Therapy and musculoskeletal science, Jim received the Alumni of the Year award from the Mayo Foundation School of Physical Therapy in 1993 and, that same year, received the “Physical Therapist of the Year” award from the Ohio Chapter American Physical Therapy Association. The Ohio Physical Therapy Association recently awarded Jim with the 2015 Meritorious Award for his service to the profession. Also for his work in “developing PT specific management software for Physical Therapy,” the Private Practice Section of the APTA awarded Jim the “2000 Practice Award.” Jim is a past member of the Board of Directors of the Private Practice Section of the APTA.

Latest posts by Jim Porterfield (see all)

- Data Management for Maximal Reimbursement and Cash Flow! - May 31, 2016

- Does Weight Training Benefit Golfers? - May 18, 2016